Besides, cases in which additions were made and taken under section 148 – which empowers assessing officers to estimate someone’s income on the basis of information available – will also be taken up.

Further, cases where there was an increase in income during the previous assessment year on account of recurring issue of law or certain specific facts before the tax authorities, should also be selected for thorough scrutiny.

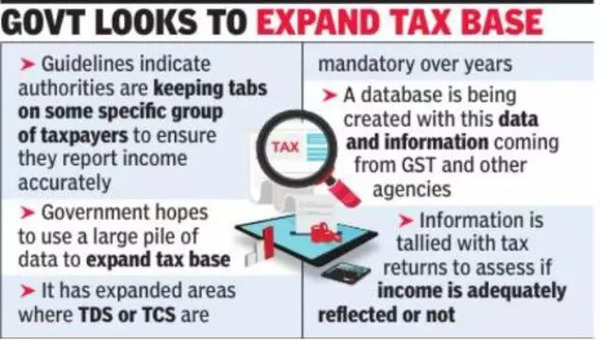

The Income Tax Department takes up specific types of cases for thorough scrutiny, relying on random checks of a small percentage of returns filed every year. The mandatory selection guidelines indicate that the authorities are keeping an eye on certain set of taxpayers to ensure that they report their income correctly.

The guidelines for the current financial year state that cases where survey or search and seizure have been conducted or where notices have been issued under section 142(1) of the Income Tax Act seeking details, should be taken up.

But while seeking mandatory scrutiny of these returns, the department has also made it clear that specified parameters will have to be followed and approval of high-ranking officials by the International Taxation Central Circle of Income Tax will be required.

The CBDT has ordered that cases taken up for scrutiny through this route need not be transferred to the Faceless Assessment Unit.

The government is looking forward to using a huge pile of available data to expand the tax base and has over the years expanded the areas where tax deduction at source (DDS) can be done.TDS) or collection at source (TCS) are now mandatory. This data is coming as well as information GST and other agencies are being used to create the database. The information is then matched with the tax return to assess whether income is adequately reflected.

The IT department on Wednesday also extended the deadline for submission of applications for registration for charitable and religious trusts till September 30.