Given the scale of economic activity and investment in these states, this trend has been more or less the same over the years.

Time series data up to 2021-22 released by Central Board of Direct Taxes (CBDT) showed India’s gross direct tax collection to grow by 173% to Rs 19.7 lakh crore in 2022-23 from Rs 7.2 lakh crore in 2013-14. As per provisional figures, net direct tax receipts are projected to increase by 160 per cent to Rs 16.6 lakh crore in 2022-23 from Rs 6.4 lakh crore in 2013-14. Direct taxes largely include personal Income tax and corporate tax. A small component of other direct taxes is also included.

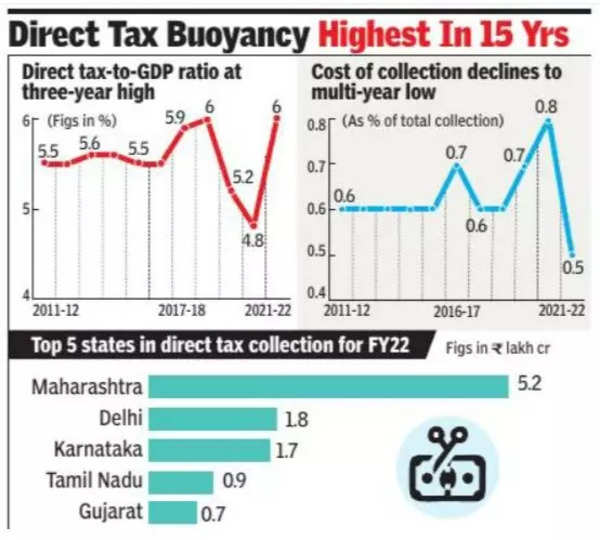

The data also showed that the net direct tax collection is expected to increase by 121% from Rs 6.4 lakh crore in 2013-14 to Rs 14.1 lakh crore in 2021-22. The direct tax buoyancy in 2021-22 at 2.5 is the highest recorded in the last 15 years. The direct-tax-to-GDP ratio has increased from 5.6% in 2013-14 to around 6% in 2021-22.

The data also revealed that the cost of collection has come down from 0.57% of total collection in 2013-14 to 0.53% in 2021-22. Direct taxes contributed to 52.3% of total tax revenue in 2021-22, up from 46.8% recorded in 2020-21. It was 36.3% in 2000-01. The data showed that the tax growth rate in 2020-21 came down to around 10% due to the impact of the pandemic on the economy. It recovers to register a growth of 49.1% in 2021-22.