Right now, who can blame sellers for holding back? The challenge is to try to find willing buyers, with the stock market down 20% this year due to rising inflation, aggressive central bank interest rate hikes and the risk of a global recession.

And any hope of a spurt in IPO action seems to be dashed. federal Reserve Wednesday saw the biggest rise in rates since 1994, and even after the bounce on Friday, the S&P 500 suffered another weekly loss. “Until relatively recently, there was a well-balanced expectation of high-quality IPOs hitting the market in September,” it said. james palmer, Head of EMEA Equity Capital Markets at Bank of America. “But looking at the market events over the past two weeks, it re-weights the degree of hope.”

Among those that have thrown in the towel recently are Coca-Cola, which delayed a planned IPO of a portion of its stake in an African bottler, and Asian insurer FWD Group Holdings, which postponed a $1 billion listing in Hong Kong. asked for.

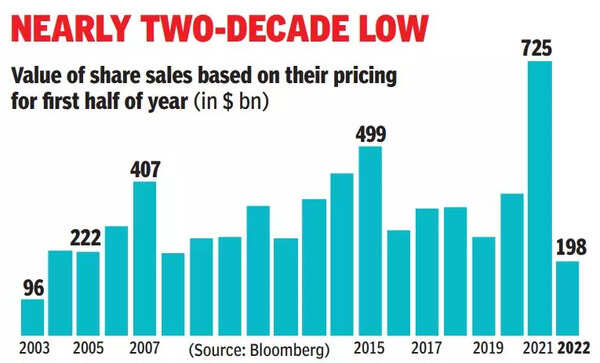

Those who have gone ahead have had to give up on their hopes. LIC, once the biggest fund raiser of the year, reduced the size of its IPO by about 60%. The decline in volume is particularly pronounced in the US, where the equity offering has been priced at just $47 billion — an 85% drop from a year ago. Once a steady source of business for New York investment bankers, cross-border listings from China have also stalled following high regulatory scrutiny. Didi GlobalThe defeat of

Some markets have bucked the trend, particularly in the Middle East. High oil prices and equity inflows are driving the IPOs in the sector towards a record first half. Energy giant Saudi Aramco is making a slew of offers for the second half, trying to take advantage of the rise in commodity prices.

There is no dearth of candidates waiting for the right time elsewhere. These include the chip designer arm, whose owner SoftBank Group aims to list the company by next March in Thai Beverages’ brewery business, which is making its third attempt to go public, and VolkswagenPorsche’s planned stock sale. Market conditions are also creating incentives for a second-half rebound in other transactions, such as convertible bond sales and spinoffs.