“Commodity markets so far have responded calmly to the onset of the conflict. This is consistent with the assumptions underlying the baseline forecast for oil,” the agency said in a report, while estimating that crude will trade around $90 a barrel this quarter, with the price for the year pegged at $84 a barrel.

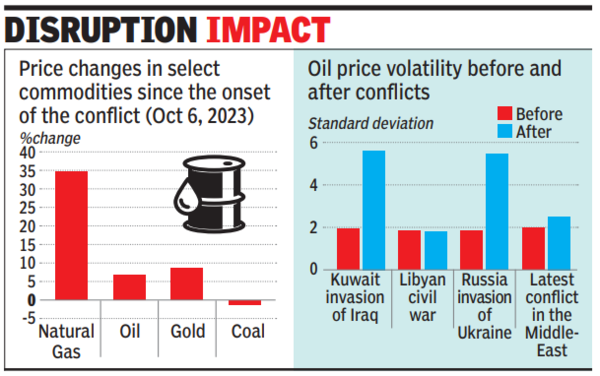

The World Bank looked at multiple scenarios, which suggested that oil pricescould increase from 3% – in case of small disruptions of around 2% decline from this year’s supply – to as much as 75%, if global supply came down by 6-8%.In the worst case scenario, prices could rise by as much as $67 a barrel or to around $157 a barrel. It also said that an escalation could hitfood supply, and push up prices, also increase the price of industrial metals (due to higher transportation cost) as well as gold, which is seen as a safe haven during turbulence.

While the report looked at previous disruptions – from the 1973-74 Arab oil embargo to the Iranian Revolution in 1978, the Iran-Iran war of the 1980s and Iraq invasion of Kuwait in 1989 – to point to price spikes, it also cited recent disruptions. “More recent conflicts in the region associated with oil supply disruptions, such as the Libyan civil war (2011), attacks on Saudi oil facilities (September 2019), and sanctions against Iran, have triggered somewhat less severe and more short-lived price spikes. The availability of supply from other sources mitigated the impact of these disruptions,” it concluded.

In addition, the Commodity Market Outlook said that the current market conditions are significantly different as the dependence on oil with the oil intensity (the volume of oil consumed per unit of GDP) reducing from 0.12 tons of oil equivalent (toe) in 1970 to 0.05 toe in 2022. With renewable energy rising, this is projected to decline even more. Further, strategic reserves built by countries and development of oil futures, along with diversified sources, were also helping provide a cushion. Besides, the economic slowdown is expected to result in energy prices declining by 5%.

“The ultimate impact of any escalation would likely depend on the magnitude and duration of oil supply disruptions that followed,” the report concluded.