Marico MD & CEO Saugata Gupta said: “A combination of weak demand sentiment, especially in rural (market) due to inflation and increased aggression of smaller players, and alternative avenues of spending have led to softer growth of FMCG this year.Having said that, the economy is on a sound footing, inflation is largely under control and the overall outlook is on an improvement trajectory.”

Price drops by large, organised players in the sector, said Gupta, will make them more competitive. “We expect the demand situation to improve as we enter the next financial year. We expect FMCG players to increase the pace of innovation & premiumisation, and also focus on significant investment behind expanding the quality of rural distribution,” said Gupta.

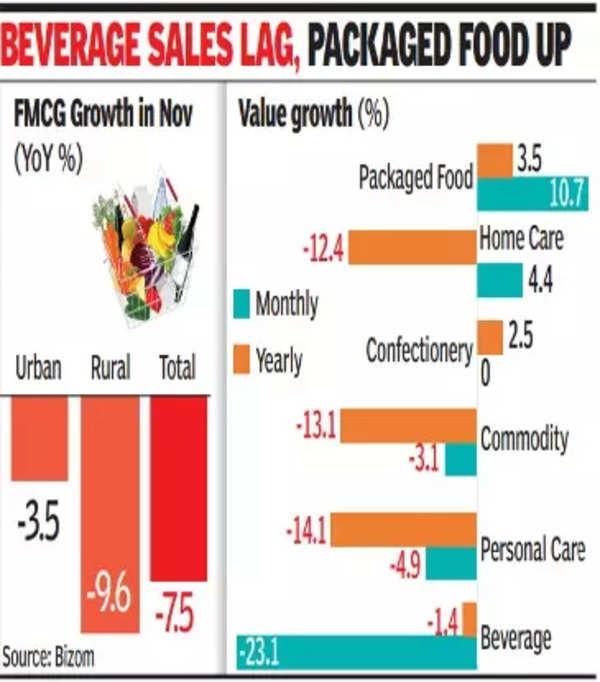

According to November 2023 data from retail intelligence platform Bizom, FMCG sales value growth declined 7.5% on a year-on-year basis on pressures of excessive stocking during Diwali.

Rural markets continued to see contraction of growth (-9.6%) as compared to urban. The festive season saw consumers purchase higher-value packs for both commodities due to preparation of sweets and savouries for the festive season.

The data showed that repeat purchases in stores are under heavy pressure for beverages, personal care driven by smaller pack size sales for both these categories. New purchases remain steady for both packaged foods and home care, and the data shows consumption of smaller packs increasing in the former, driven by strong out-of-home consumption. Confectionery sales saw flat growth in November 2023 as stocking of gift packs continues to liquidate after the festival and new purchases see an increase in smaller packs being stocked in stores.

Bizom chief of growth and insights Akshay D’Souza said a bounce-back in rural FMCG consumption would likely take longer.

“As inflation dropped this year, we saw kiranas focus on stocking more essential products. As a result, we see many non-food discretionary products such as shampoos and hair colours dropping prices to fuel consumption. This could continue through early 2024 if input prices remain steady. Also for 2024, we do expect to see that essentials like rice, wheat and sugar could see a further drop in prices as India’s export ban will help create additional supply in the local market which could keep prices in check. With prices being in check and a stable economy, we could well see consumption fuelled in early 2024,” said D’Souza.