Axis Asset Management The company, which is India’s seventh-largest mutual fund manager and is partly owned by Schroders, in May sacked two employees, including its main dealer, amid an internal investigation.

In early July, the fund submitted its findings to regulators, saying it had evidence to believe that the fired executives violated securities law. Meanwhile, the Securities and Exchange Board of India is conducting its own investigation on a possible front by two people, said a person familiar with the agency’s investigation, asking not to be identified while discussing personal information.

running A major is the trading of shares by someone with knowledge of imminent transactions that will move prices. It is illegal in India, and a massive search and seizure operation has been conducted at offices and residences by the market regulator. Axis Mutual Fund executives, and other stockbrokers and traders, the person said. The person said that after receiving surveillance alerts and inputs from the stock exchanges by certain parties regarding suspicious front in trades of Axis Mutual Fund, the regulator’s probe covered 30 locations in different cities.

Interviews with nine people familiar with the investigation revealed how a pandemic-fueled boom in India’s investment industry has made it harder for officials and regulators to manage the fallout of that outsized development. British investment giant Schroders holds a 25% stake in Axis Asset Management axis Bank Ltd. Rest Holding.

Some corporations have withdrawn money from the Indian firm’s funds following allegations, another person familiar with the matter said, asking not to be named as they were not authorized to speak publicly. Axis Mutual Fund did not respond to questions about corporate withdrawals, but said in a public statement that the firm has adhered to regulatory guidelines at all times and believes that the conduct of individuals concerned will affect its liquidity or operations. has no effect on. Schröders and Axis Bank did not respond to emails seeking comment.

Former chief dealer Viresh Joshi has filed a lawsuit alleging wrongful dismissal and has sought Rs 54.3 crore, his law firm Mansukhlal Hiralal & Co said in an email. Deepak Agarwal, another employee named by the firm, could not be contacted for comment. A call and a message to a mobile number that was previously believed to be his was not answered, and Bloomberg was not able to obtain any other contact information for him or any of the representatives he hired was.

Meanwhile, legal experts are predicting more scrutiny for the entire Indian mutual fund industry.

“The scale at which the regulator is probing the matter leads us to believe that SEBI means serious business,” said Sumit Agarwal, founder, Regstreet Law Advisors and former legal advisor to the market regulator. “We expect a swift investigation and action that could result in stricter regulations for fund managers.”

Going forward, checking bank accounts and tax returns of fund managers and dealers and their close relatives is likely to increase, he added.

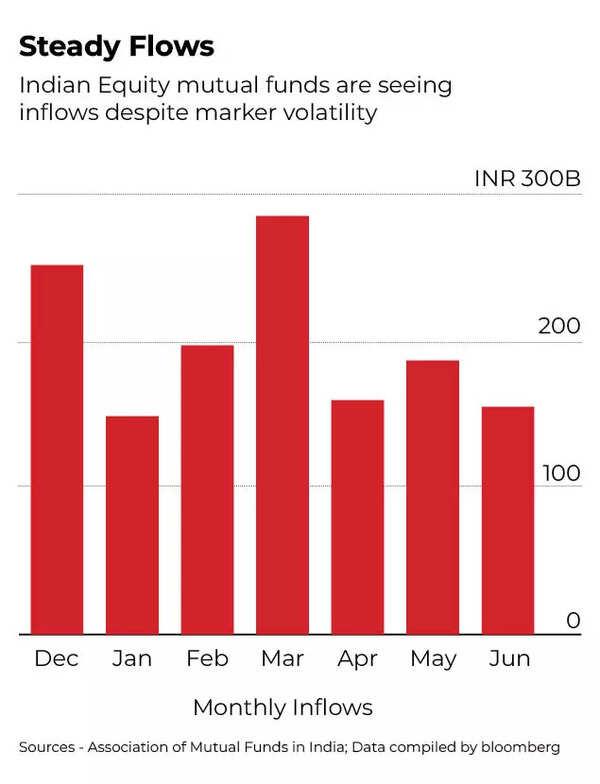

Mutual funds, which fall somewhere between high-risk stock trading and low-return bank deposits, have made an attractive proposition for both young and risk-averse old investors in India. According to the Association of Mutual Funds in India, the industry has grown nearly five times in the last decade, with over Rs 37 lakh crore in assets at the end of June.

Investors were net buyers of equity-based funds for the sixteenth consecutive month in June, even as concerns about high inflation and tighter monetary policy kept equity markets volatile.

Axis Mutual Fund joined the industry with its first investment plan in 2009, and had assets of Rs 2.5 lakh crore under management at the end of June this year. One of the earliest members of its team was Viresh Joshi,

In the coming years, Joshi grew in the company and in 2019 became the main dealer, overseeing its business operations. He was involved in executing trades in the glass-walled dealing room on the first floor of the firm’s office, until the pandemic in 2020. Most people were forced to work from home.

Dealing rooms for mutual funds are strictly controlled spaces equipped to record every movement inside. The dealing rooms of Axis Mutual Fund have cameras to monitor all activities, desk phone lines are recorded while the use of mobile phones is prohibited.

compliance lapse

It is not publicly known whether Joshi worked from home during the pandemic or from the dealing room. But in January this year, the company management was told informally by other market participants that there was something wrong with the transactions executed by Joshi, according to two people familiar with the developments of the case, who asked for anonymity while discussing confidential Told. description. People said Joshi’s absence during business hours was also vague.

The firm decided to investigate and asked Alvarez & Marsal Inc. to help. In early May, Axis Mutual Fund said it had suspended Joshi and another fund manager, Deepak Agarwal, pending an internal investigation into possible irregularities. Soon after, people familiar with the matter told Bloomberg that SEBI was investigating whether the two men were involved in further races.

Chirag Shah, a lawyer for the law firm representing Joshi, said via email, “We believe that our client is being made a scapegoat and that his dismissal is wrong and illegal and that he has been denied the principles of natural justice.” Is.” “When we wrote to Axis Mutual Fund to explain what the allegations were or whether there was a show cause notice, they did not provide that to us.”

The law firm also said that the asset manager did not take any action on several complaints filed by Joshi when he noticed price hikes before he was able to execute the orders given to him.

Axis Mutual Fund, in an emailed reply, said the fund house will address the claims made by Joshi in his suit before the court.

“We have more than sufficient findings regarding violations of our policies, including non-cooperation with our internal investigations (during their suspension period). We have strong reasons to believe that their There has been a serious and persistent violation of securities laws by

strict rules

The investigation has raised questions about possible compliance lapses and practices during the Covid-19 restrictions of the past two years, with key stock gauges clocking several highs. Meanwhile, the new head of SEBI in India, Madhabi Puri Buch, has attempted to crack down on market vagaries as equity mutual funds lured billions of dollars inflows.

In late May, the markets regulator sent a circular to brokerages and fund houses withdrawing the flexibility to work from home for employees handling critical functions related to investments, compliance and risk management, brokers who saw the circular but they are not allowed to be quoted, said. SEBI did not respond to an email seeking comment.

Meanwhile, some analysts have raised concerns about a possible downside in Axis Asset Management.

Primeinvestor.in, a financial research platform for retail investors, has recommended exit from the company’s small cap funds and halted its midcap and flexicap funds, partly due to scrutiny over concerns about redemptions. Other challenges such as poor flows due to market turmoil. Media representatives for Axis did not respond to a request for comment on the research firm’s views.

“We are concerned about whether this allegation will turn into a full-fledged corporate governance issue,” said Vidya Bala, head of research and co-founder, primeinvestor.in. “As of now, the depth of the issue and the fault lines are yet to be explained, but where such serious allegations have been made, there are a number of incidents that could damage investors’ holdings even before the issue is resolved. ”