In the last two years, BSE’s financial services index has risen 35% while the banking index is up 31%. The global financial major on Friday downgraded SBI, ICICI Bank and Yes Bank, retained its ‘buy’ rating on HDFC Bank while it upgraded Bajaj Finance to ‘neutral’ rating from ‘sell’.

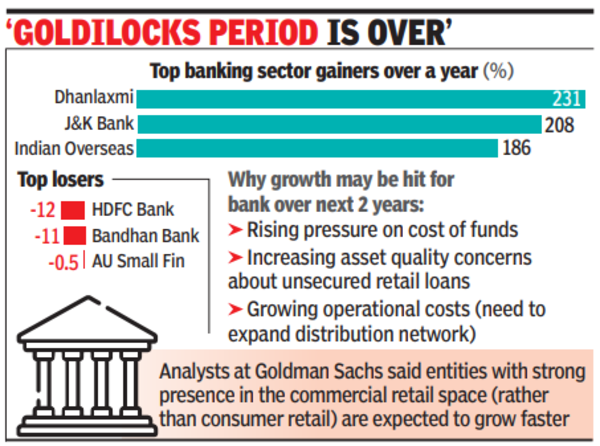

“We believe the proverbial Goldilocks period – strong growth and strong/visible profitability – is over for the financial sector in the near-term as headwinds are increasing,” the report by Goldman Sachs noted.

The headwinds include rising pressure on cost of funds due to structural challenges in the funding environment. Another negative for the banking and financial sector could be the growing concerns on rising consumer leverage posing potential asset quality challenges, particularly in the unsecured lending space, leading to higher credit costs. It also listed pressure on operating costs for banks and financials due to elevated wage inflation as well as the need to expand the distribution network for future deposit growth as a headwind.

Analysts at Goldman Sachs said they preferred lenders that are strong in the commercial retail space, compared to the ones that have strong presence in the consumer retail space. They believe entities with strong presence in the commercial retail space are expected to grow faster and offer a much better returns profile.

Goldman Sachs expects up to 37% downside in Yes Bank’s stock price, between 3% and 4% in SBI and ICICI Bank but sees up to 33% upside in HDFC Bank.