The type of loan also affects the home loan interest rate. (Representational Image)

Home loan interest rates are affected by a number of factors, including the RBI repo rate, the borrower’s risk assessment by the lender and the type of loan.

Home loan interest rates in India are the interest rates charged by banks and other financial institutions on home loans. It is important for potential homebuyers to compare and analyze various home loan rates offered by different lenders to find the most favorable terms that suit their financial situation. Lower interest rates can lead to lower Equated Monthly Installment (EMI) payments and overall cost savings over the loan tenure.

The interest rate is a percentage of the loan amount that the borrower must pay to the lender in addition to the principal amount. The interest rate is usually expressed as an annual percentage rate (APR). These rates determine the cost of borrowing and affect the monthly EMI that borrowers need to pay.

Read also: Struggling to pay off debt? Here’s how you can make timely payments and avoid default

Home loan interest rates vary from lender to lender and from time to time. It is important to check and compare the interest rates of various lenders before applying for a home loan. You should also consider the other terms and conditions of the loan, such as the loan amount, repayment tenure and processing fee.

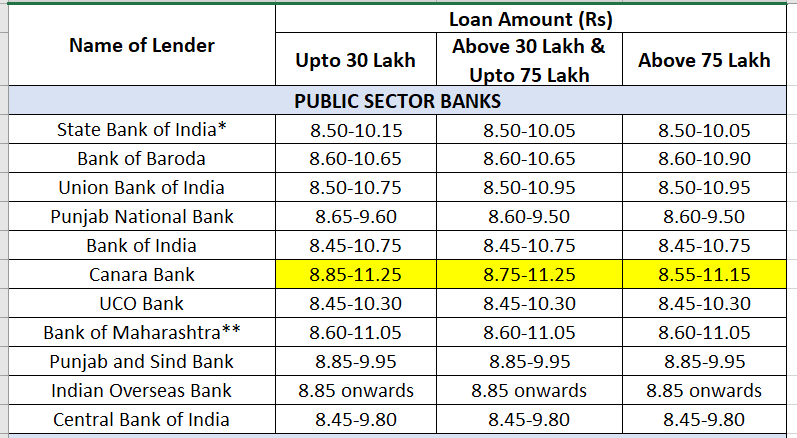

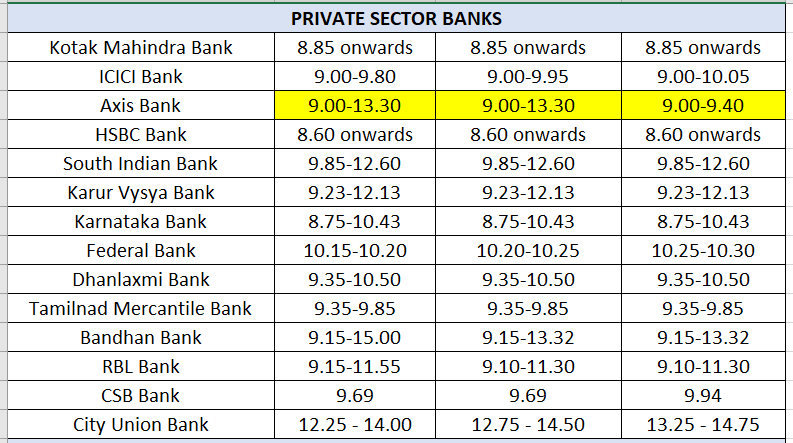

Here are two tables showing interest rates on home loans as on June 14.

Home Loan Interest Rates: Public Sector Banks

Home Loan Interest Rates: Private Sector Banks

Factors Affecting Home Loan Rates

Home loan interest rates are influenced by several factors including the Reserve Bank of India (RBI). repo rate, the risk assessment of the borrower by the lender, and the type of loan. RBI’s repo rate is the rate at which banks borrow money from RBI. When the RBI increases the repo rate, it becomes more expensive for banks to borrow money, which leads to higher home loan interest rates.

RBI in its latest MPC decision again hit the pause button and decided to keep the key benchmark policy rate (repo rate) at 6.5%.

The risk assessment of the borrower by the lender is also a factor in determining the home loan interest rate. borrower with good credit score And a proven track record of repaying loans is usually offered lower interest rates than borrowers with poor credit scores or a history of late payments.

The type of loan also affects the home loan interest rate. For example, interest rates on floating rate loans are linked to a benchmark rate, such as the repo rate of the RBI. When the benchmark rate changes, the interest rate on the floating rate loan also changes.

Fixed rate loans have interest rates that are fixed for a period of time, such as five years. This means that the interest rate on a fixed rate loan will not change during the fixed rate tenure.