sbi research reportecowrap‘ Said that decision In fact there will be a favorable impact on liquidity, bank deposits and interest rates.

The report was released on Tuesday when 131-day window opened to exchange demonetised Rs 2,000 notes With shorter queues at some banks and a mixed bag of confusion.

Unlike in November 2016, when the old Rs 500 and Rs 1,000 notes – which constituted about 86 per cent of the currency in circulation – were banned overnight, resulting in long queues outside bank branches across the country. This time the crowd is not being seen.

The report states that the entire amount of about Rs 3.6 lakh crore will be returned to the banking system in the form of Rs 2,000 notes (the report assumes that 10-15 per cent of the total Rs 2,000 notes are in currency chests).

This is partly due to the longer period (September 30) for exchange of these notes and other factors such as changes in the composition of bank notes and increase in digital transactions.

Here are some reasons why demonetisation of Rs 2,000 note will be a non-event…

changing the composition of notes

The report states that the composition of bank notes has been changed after the post demonetisation In 2016.

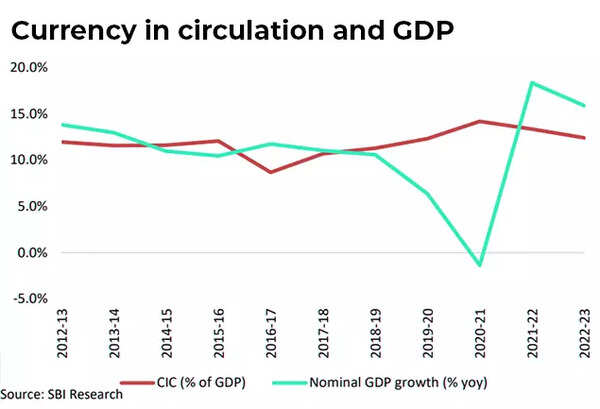

It added that currency in circulation has reached 12.4 per cent of GDP in FY23, almost the same level as in 2015-16.

Overall, the share of small denomination notes (up to Rs 100) declined from 26.7% in 2017 to 9.0% in value terms and from 90.8% to 58.8% in 2017 in volume terms.

Meanwhile, currently Rs 500 note has become the dominant bank note among the public and accounts for 73.3% of the total value of currency notes as of March 2022.

The report states that the RBI has ensured that the fraction of the largest Rs 2,000 note gradually went down over the years, thus paving the way for their complete removal from circulation.

The printing of notes was stopped in 2018-19.

According to the RBI, the share of Rs 2,000 notes had fallen to 10.8% of the total value of currency notes, or Rs 3.62 trillion, as of March 23.

“Decoding exchange/deposit dynamics, we understand, banks will already be holding some of these notes in their currency chests, thus limiting the impact on deposits,” it said.

Rise of UPI

The report further states that in digital payments, India is witnessing new milestones in terms of both value and volume, indicating the strength of its payments ecosystem and acceptance by a wide range of consumers.

The report states that the percentage of “total digital payments” to the country’s nominal GDP has increased from 668% in FY2016 to 767% in FY23.

Retail digital payments (excluding RTGS) as a percentage of GDP has grown from 129% in FY2016 to 242% in FY23.

The report states that among all, UPI has emerged as the most popular and preferred payment mode in India, leading in person-to-person (P2P) as well as person-to-merchant (P2M) transactions in India, which accounts for about 73 per cent of the total digital payments. ,

“UPI transaction volume has increased from 1.8 cr in FY17 to 8,375 cr in FY23. The value of UPI transactions has also grown from just Rs 6947 cr to Rs 139 lac cr during the same period. 2004 times,” The report said.

UPI is also popular in rural areas

The report states that contrary to popular belief that UPI is preferred only in metro cities, data shows that it is widely used in rural/semi-urban areas as well.

“Rural and semi-urban areas account for 60% of the UPI value/volume. This result is quite surprising and indicates higher participation of digital means of payments and less dependence on cash in non-metro areas,” it said.

The report states that in the month of April 2023 alone, 414 banks/PPIs were live on the UPI interface, wherein 8.9 billion financial transactions were carried out for a total value of approximately Rs 14.1 trillion, with an average ticket size of Rs 1,600.

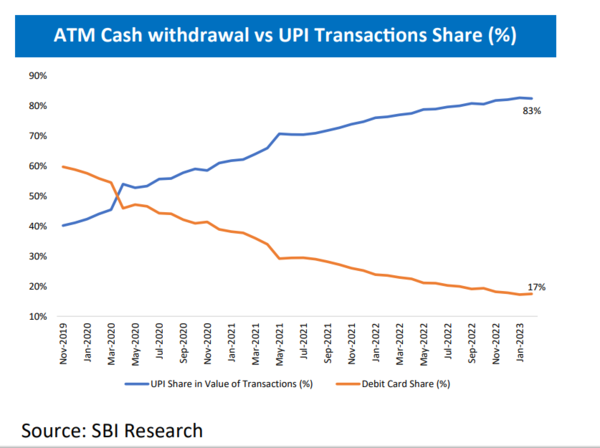

It further said that in retail demand for money, UPI’s share in value has increased to 83%, while the share of cash withdrawals from ATMs has come down to 17%, indicating that people are replacing cash with UPI.

“The importance of UPI can be gauged from the fact that the size of GDP has increased by 1.8 times to Rs 272 lakh crore in FY23 as compared to FY2017, with total ATM transaction value (using only debit cards) of Rs. 30-35 lakh crore. ATM transactions fell from 15.4% of GDP in FY17 to 12.1% of GDP in FY23,” it said.

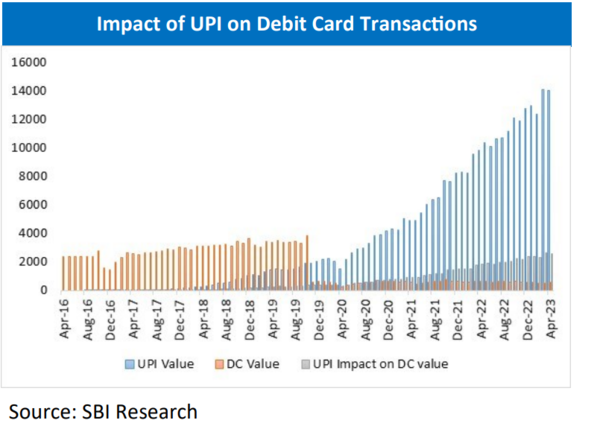

The study found that both debit card transactions and ATM withdrawals actually declined due to UPI.

It said a time series analysis for the period April 2016 to April 2023 indicates that a person is now visiting ATMs an average of 8 times in a year, down from 16 earlier.