Last Update: July 11, 2023, 02:49 AM IST

United States of America, USA)

A man carries empty water bottles near the bronze replica of Wall Street’s Charging Bull inside the premises of the Bombay Stock Exchange (BSE) in Mumbai on February 1, 2023. (Reuters)

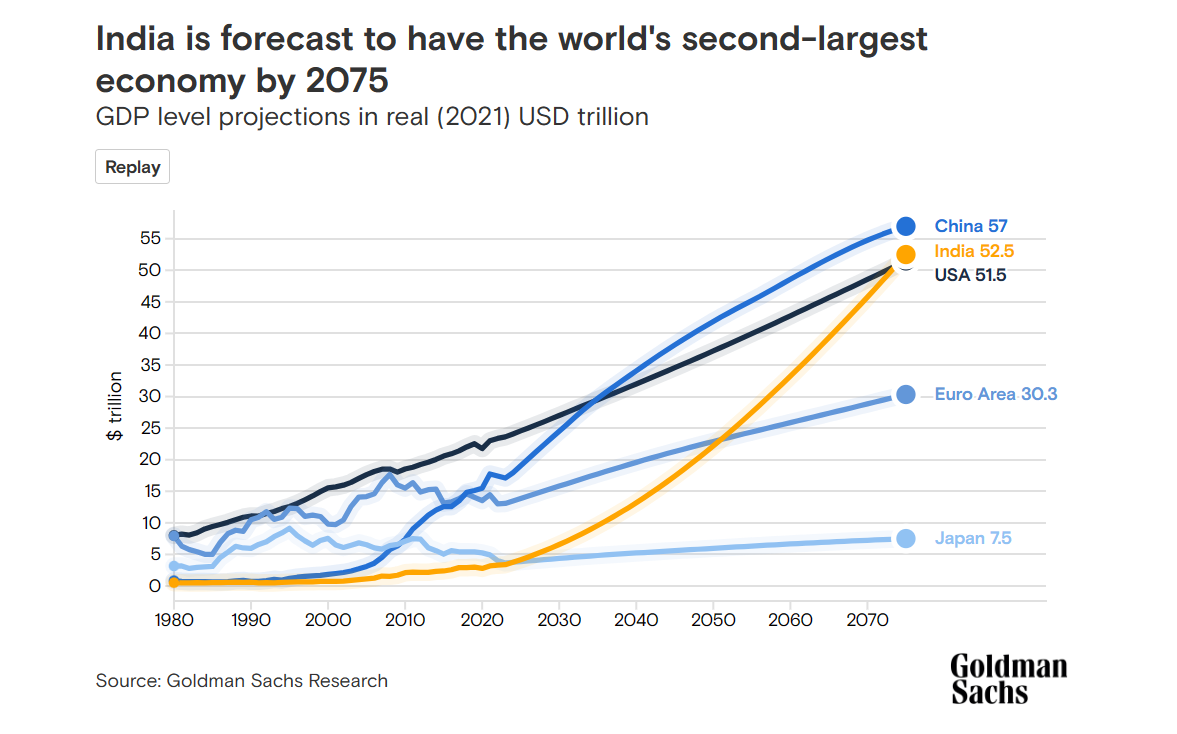

India’s long-term forecast predicts that it will overtake the US and become the world’s second largest economy by 2075. There will be several key factors

According to a forecast by American investment bank Goldman Sachs, India is projected to become the world’s second largest economy by the year 2075, overtaking the United States. As the most populous country on the planet with 1.4 billion people, India’s potential lies in boosting labor force participation and providing training and skills to its vast talent pool.

At present, India stands as the fifth largest economy in the world. But the country’s favorable demographics, innovative progress and rising labor productivity compared to Germany and Japan are expected to be key drivers of its economic growth. Capital investment and favorable demographics, such as a low dependency ratio, are likely to contribute to India’s future expansion.

Shantanu Sengupta, India economist at Goldman Sachs Research, argued that India has made more progress in innovation and technology than some might imagine.

“Yes, the country has demographics in its favour, but that will not be the sole driver of GDP. Innovation and increasing worker productivity are going to be key to the world’s fifth-largest economy. In technical terms, it means more output for each unit of labor and capital in India’s economy.”

According to Sengupta, capital investment is also going to be an important driver of growth going forward.

However, challenges remain in harnessing the potential of the labor force and increasing the labor force participation rate. According to Goldman Sachs, the demographic transition in India is slowly taking place, and the country needs to leverage its large population to set up manufacturing capacity, spur infrastructure development and effectively utilize its vast talent pool. Needed

India’s focus on building infrastructure, both by the government and the private sector, is seen as an important step in absorbing the large labor force and creating job opportunities. The report noted that risks to India’s economic growth include stagnant labor force participation rates and low productivity growth, especially among women.

To mitigate these risks, India must create more opportunities for women in the workforce and continue investing in digitization and technological advancement. India’s economy is primarily driven by domestic demand and consumption, with net exports historically acting as a constraint on growth.

However, recent progress in service exports has helped reduce the current account imbalance. Commodity prices also play an important role in India’s broader economy, affecting inflation, fiscal deficit and current account deficit. As a large energy consumer, India’s current account imbalance is impacted by the energy import bill.

While India moves towards green energy, fossil fuels will continue to dominate the energy mix in the interim. The government has set ambitious targets for renewable energy generation, aiming to get 50 percent of electricity capacity from non-fossil sources by 2030 and reach net zero emissions by 2070.

According to the report, this change presents a significant investment opportunity, although this change will take time. Meanwhile, India is actively promoting electric vehicles, green hydrogen and renewable energy to accelerate its energy transition.

This latest report comes as S&P Global and Morgan Stanley have projected India to become the world’s third largest economy by 2030. The country’s first-quarter GDP exceeded expectations, rising 6.1 percent year-on-year, surpassing an earlier forecast of 5 percent growth. ,

(with agency inputs)