London-headquartered BAT will sell nearly 44 crore shares of ITC at a price band of Rs 384-400 through block deals on Wednesday, the deal’s term sheet showed.At the lower end of the price band, the shares are priced at a 5% discount to the stock’s Tuesday close on the BSE at Rs 404.

ITC’s block deal will be one of the largest in India. The biggest block deal in India was executed in May 2020 when global pharma major GSK had sold 5.7% in FMCG major HUL for about Rs 25,600 crore.

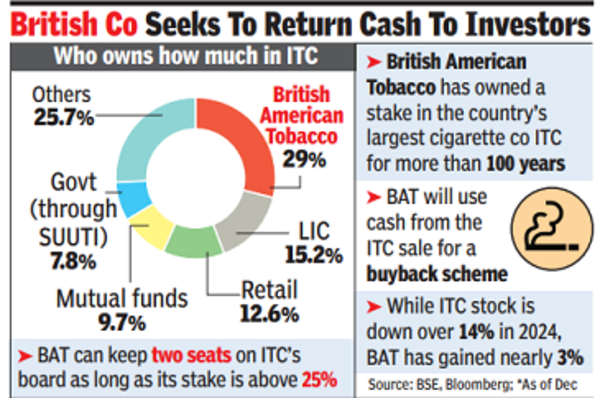

BAT holds a little over 29% stake in ITC but it is not the promoter of the company. BAT’s top management has been talking about monetising part of its stake in ITC for three to four months, provided it could successfully navigate India’s strict foreign holding rules in tobacco companies. BAT had indicated that it’s holding in ITC would not fall below the strategically important 25% mark. “They (BAT) will continue to remain a major shareholder in ITC,” a source told TOI.

On Tuesday evening, BAT through a statement said that after the completion of this block trade, “BAT will remain a significant shareholder of ITC, with (about) 25.5% holding.” The global tobacco major intends to part with its proceeds from stake sale in ITC to pay dividend this and the next year, “starting with 770 million pounds in 2024”.

Domestic fund managers holding ITC shares in their portfolios are not a worried lot as the block deal will increase the supply of shares of the Indian major. In the long run, this could be beneficial to ITC shareholders, an Indian fund manager holding ITC shares said.

First, ITC, a major sensex constituent, has a free float weighted market capitalisation of Rs 3.6 lakh crore, against its full market cap of a little over Rs 5 lakh crore. So, its current free float index is 71%, which excludes the BAT’s 29% holding. After the block deal, ITC’s free float index will increase to 74.5%. This will increase its weight in the sensex, which in turn will attract buying of this stock by funds that are benchmarked to the index, the fund manager said.

Second, the block deal will marginally reduce a supply overhang in ITC. The continuing expectations of govt arm SUUTI (7.8% holding) offloading a stake in ITC is a permanent supply overhang on the stock. With BAT intending to maintain its stake in ITC at 25%, the supply overhang in ITC now reduces a bit, the fund manager said.