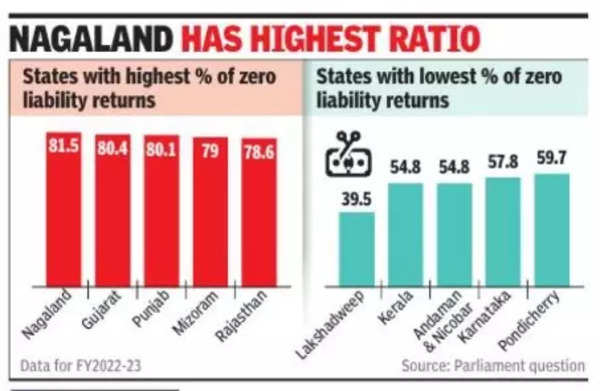

At an all-India level, of the 7.4 crore returns filed during FY 2022-23, a little less than 5.2 crore or nearly 70% had no tax due liability,

The state-wise numbers shared in the Lok Sabha put Maharashtra on top in both the cases – over 1.1 crore returns were filed with nearly 74 lakh zero-liability ITRs. At the other end of the spectrum is Lakshadweep, where less than 40% of the 4,454 returns filed, or 1,761 returns, had zero liability. During the last financial year, 74.5 lakh returns were filed in Gujarat.

While taxpayers earning less than Rs 2.5 lakh in a financial year do not have to pay income Taxes, many individuals file returns because they have to claim refunds, for example tax deducted at source or just to keep a record so that they can avail credit. Often, returns are filed when an individual, who is a taxpayer, sees a drop in income below the threshold.

Also, the actual income required to pay taxes with the standard deduction and exemption is now much higher.