During the quarter, LIC sold a total of 37,278,466 shares of the three Adani companies, while also purchasing 4,500 shares of Ambuja Cements, according to an ET report.

The stake held by LIC in Adani Group companies became a controversial topic between the ruling BJP and Congress parties following the Hindenburg controversy that arose in January-end 2023. LIC denied allegations of political pressure and stated that the market value of its investments in Adani Group stocks was Rs 56,142 crore as of January 27th, 2023.

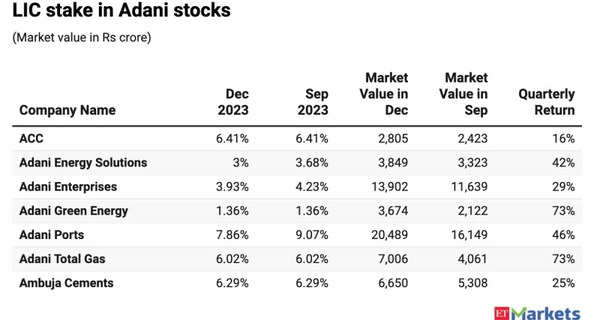

LIC’s holdings in Adani Group increased to Rs 58,374 crore at the end of the December 2023 quarter, up from Rs 45,025 crore at the end of September 2023, the report said.

Here’s a breakdown of LIC’s stake in each of the Adani companies:

1. Adani Energy Solutions: LIC reduced its stake from 3.68% in the September quarter to 3% in Q3. The stock saw a 42% increase during the quarter.

LIC stake in Adani stocks

2. Adani Enterprises: LIC’s ownership in the flagship company of the Adani Group decreased from 4.23% to 3.93% quarter-on-quarter. The Nifty stock showed a growth of almost 29% in Q3.

3. Adani Ports: LIC also reduced its stake in Adani Ports, where it has a significant investment in the Adani Group, from 9.07% in Q2 to 7.86% in Q3. The stock experienced a remarkable rally of over 46% during the quarter, with LIC’s stake valued at over Rs 20,000 crore.

LIC’s stake in other Adani stocks, including ACC, Adani Green Energy, and Adani Total Gas, remained unchanged. Adani Green was the best-performing stock in LIC’s portfolio, showing a growth of over 73% in Q3.

During the quarter, LIC made a small purchase of 4,500 shares of Ambuja Cements, but its percentage shareholding remained unchanged at 6.29%.

The Adani vs Hindenburg issue is still ongoing, despite the Supreme Court ruling out transferring the investigation to other agencies. The Securities and Exchange Board of India (SEBI) is currently conducting investigations into the allegations against the Adani Group, with 22 out of the 24 investigations completed. The apex court has urged SEBI to expedite the two pending investigations, ideally within the next three months.