Digital banking platform MobiKwik has launched Lens, an app that will provide users with an understanding of their money and aid in financial wellness.

Mobikwik Lens leverages the Account Aggregator technology, which is a data science framework, to make complex financial data digestible and actionable. It also helps users share data across financial institutions in a secure and efficient manner, the company said.

Earlier, it was a tedious manual process involving countless spreadsheets and now it is available at one’s fingertips, it added.

“Lens addresses the fundamental aspects of financial wellness – awareness and control over one’s money. Our research showed that it’s difficult for individuals to monitor their financial inflows, outflows, and transactions at a granular level,” said Bipin Preet Singh, co-founder and CEO of MobiKwik.

“Lens empowers informed decision making, enabling users to make proactive choices about their finances,” Singh added.

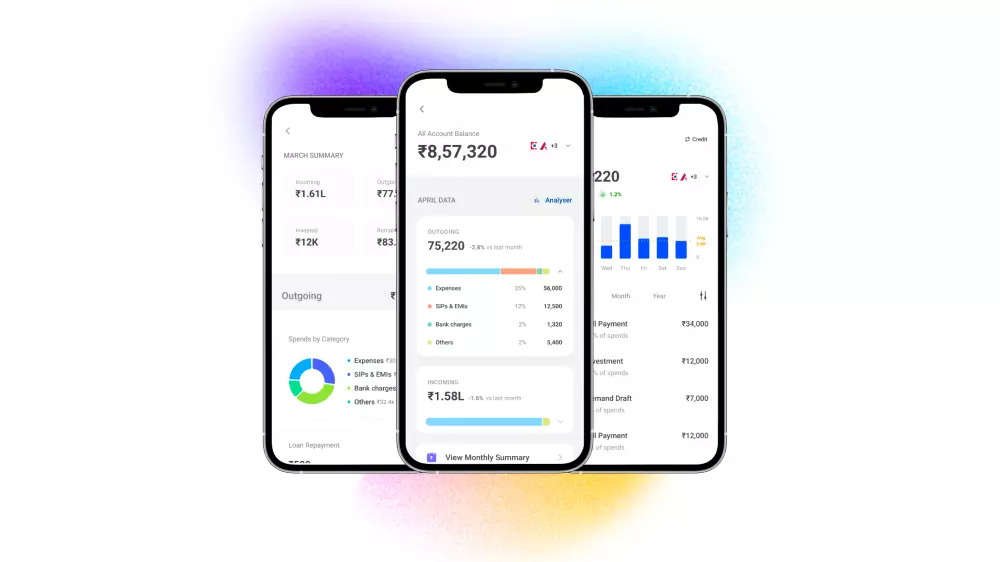

MobiKwik Lens offers a suite of features, including but not limited to an overview of one’s net worth with transaction details, smart categorisation of incoming and outgoing money, trends of bank account balance, spends, investments, and repayments.

Users can download their bank statements, and better understand their upcoming bills and recurring payments and expenses to better budget their monthly spends.

The product comes with a feature called ‘Highlights’ that prompts for a user’s attention at the right time. For example, there is a refund a user is expecting from an apparel retailer, MobiKwik Lens will highlight that the refund has been credited to the account.

Similarly, any unusual deductions like overdraft fees get highlighted immediately. It will tell how expenses are increasing or decreasing over a period of week, month, and year.

“With a commitment to innovation, we will further enhance Lens with new features to not only get financial intelligence across multiple bank accounts but also get a 360-degree view of their money across investments, insurance, and pension funds,” Singh added.

Mobikwik Lens leverages the Account Aggregator technology, which is a data science framework, to make complex financial data digestible and actionable. It also helps users share data across financial institutions in a secure and efficient manner, the company said.

Earlier, it was a tedious manual process involving countless spreadsheets and now it is available at one’s fingertips, it added.

“Lens addresses the fundamental aspects of financial wellness – awareness and control over one’s money. Our research showed that it’s difficult for individuals to monitor their financial inflows, outflows, and transactions at a granular level,” said Bipin Preet Singh, co-founder and CEO of MobiKwik.

“Lens empowers informed decision making, enabling users to make proactive choices about their finances,” Singh added.

MobiKwik Lens offers a suite of features, including but not limited to an overview of one’s net worth with transaction details, smart categorisation of incoming and outgoing money, trends of bank account balance, spends, investments, and repayments.

Users can download their bank statements, and better understand their upcoming bills and recurring payments and expenses to better budget their monthly spends.

The product comes with a feature called ‘Highlights’ that prompts for a user’s attention at the right time. For example, there is a refund a user is expecting from an apparel retailer, MobiKwik Lens will highlight that the refund has been credited to the account.

Similarly, any unusual deductions like overdraft fees get highlighted immediately. It will tell how expenses are increasing or decreasing over a period of week, month, and year.

“With a commitment to innovation, we will further enhance Lens with new features to not only get financial intelligence across multiple bank accounts but also get a 360-degree view of their money across investments, insurance, and pension funds,” Singh added.