TVS Vice President of Supply Chain Solutions R Dinesh has taken over as the new chairman of CII, He tells TOI that most companies are looking to increase capital expenditure as capacity utilization has crossed 80% in many areas, while FDI is set to rise as companies bet on strong domestic demand in India. Excerpts:

How do you view the capacity expansion cycle? Which are the sectors where you are seeing growth?

Our survey found that it cuts across all sectors that have crossed 75% and includes manufacturing and services. The utilization of cement, steel, machinery and chemicals has all passed 80%. Services include transport, hotels, aviation all beyond this. Usually at 75 percent people start talking about new investments. The fear of uncertainty has not been there, at least in the last 7-8 months. Earlier something or the other was unfolding, be it the Covid crisis or the Ukraine crisis. I would call it a more stable period now. So, both are precursors of important capex going up The commitment to invest and the need for investment is already happening.

What about exports and how harmful will it be?

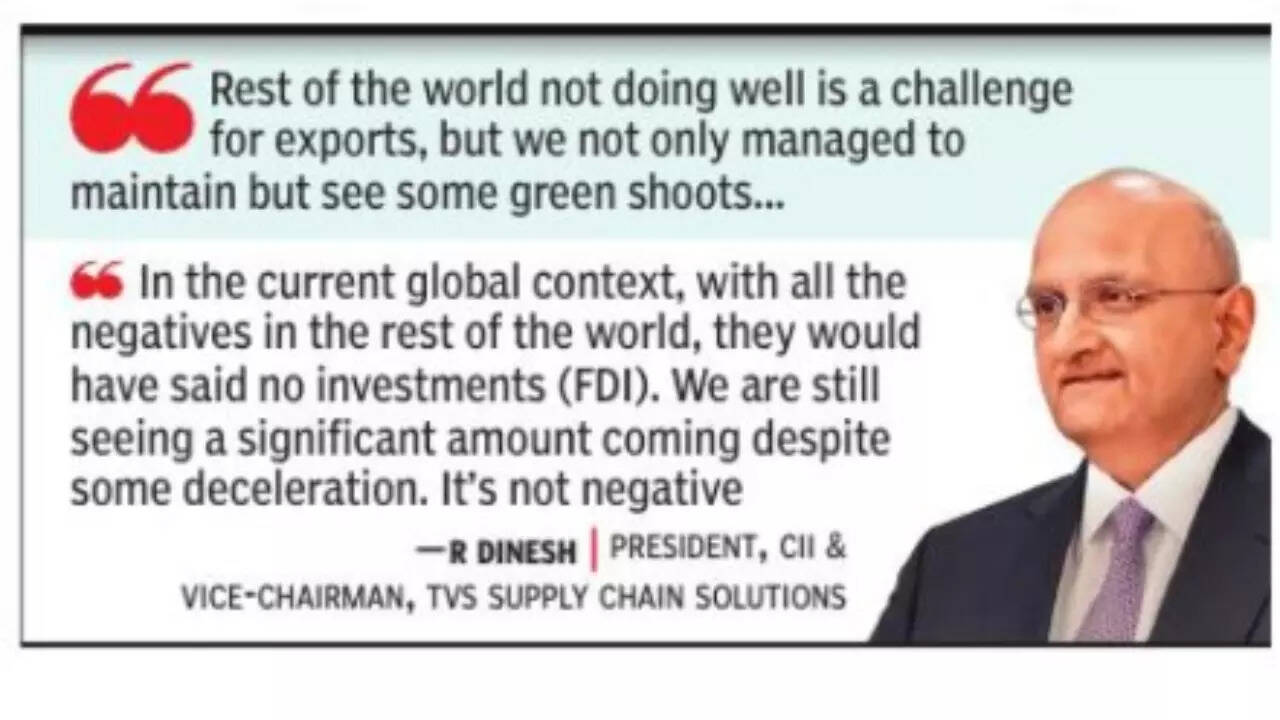

We were really worried about it, but if you look at the April numbers, exports have continued to grow to some extent. In the current global context, the growth rate is low due to low demand. Rest of the world not doing well is a challenge for exports but we not only managed to sustain but also saw some green shoots. Companies coming due to domestic demand are also becoming exporters. So the capacity they are creating will also be used to meet the global demand.

The latest FDI numbers show that FDI has declined for the first time in 10 years.

In the current global context, with all the negativity in the rest of the world, he would have said that there is no investment. Despite some slowdown we are still coming in great quantities. It is not negative. For those who have decided to invest, it will take some time to set up the facility. It is a process that will happen. Investment will be purely on domestic demand, which is far more sustainable.

What are the uncertainties you see domestically?

Domestically there is only one issue, that is the monsoon. If we look at the infrastructure expenditure, the government is busy in it at full speed. Rural demand has come back in the last four-five months.

What about external uncertainties – slowing global economy, Russia, Ukraine war?

The Ukraine crisis and the global recession are both challenges for us. But we will be in a better position as domestic demand diverts all attention from abroad to our production or manufacturing capacity.

What about interest rates?

Inflation is a challenge. Is inflation coming down? Yes. With 72% of the CEOs we polled saying they are looking at 4.5-5. 5% inflation. Don’t forget that this is in a world where developed economies are talking about double digit inflation while they are used to 1-2% inflation. Netnet India has come out much better than many countries. RBI has managed the inflationary situation very well. He has not affected the development and he has supported it.

How do you view the capacity expansion cycle? Which are the sectors where you are seeing growth?

Our survey found that it cuts across all sectors that have crossed 75% and includes manufacturing and services. The utilization of cement, steel, machinery and chemicals has all passed 80%. Services include transport, hotels, aviation all beyond this. Usually at 75 percent people start talking about new investments. The fear of uncertainty has not been there, at least in the last 7-8 months. Earlier something or the other was unfolding, be it the Covid crisis or the Ukraine crisis. I would call it a more stable period now. So, both are precursors of important capex going up The commitment to invest and the need for investment is already happening.

What about exports and how harmful will it be?

We were really worried about it, but if you look at the April numbers, exports have continued to grow to some extent. In the current global context, the growth rate is low due to low demand. Rest of the world not doing well is a challenge for exports but we not only managed to sustain but also saw some green shoots. Companies coming due to domestic demand are also becoming exporters. So the capacity they are creating will also be used to meet the global demand.

The latest FDI numbers show that FDI has declined for the first time in 10 years.

In the current global context, with all the negativity in the rest of the world, he would have said that there is no investment. Despite some slowdown we are still coming in great quantities. It is not negative. For those who have decided to invest, it will take some time to set up the facility. It is a process that will happen. Investment will be purely on domestic demand, which is far more sustainable.

What are the uncertainties you see domestically?

Domestically there is only one issue, that is the monsoon. If we look at the infrastructure expenditure, the government is busy in it at full speed. Rural demand has come back in the last four-five months.

What about external uncertainties – slowing global economy, Russia, Ukraine war?

The Ukraine crisis and the global recession are both challenges for us. But we will be in a better position as domestic demand diverts all attention from abroad to our production or manufacturing capacity.

What about interest rates?

Inflation is a challenge. Is inflation coming down? Yes. With 72% of the CEOs we polled saying they are looking at 4.5-5. 5% inflation. Don’t forget that this is in a world where developed economies are talking about double digit inflation while they are used to 1-2% inflation. Netnet India has come out much better than many countries. RBI has managed the inflationary situation very well. He has not affected the development and he has supported it.