Mumbai: The reserve Bank of India has said there is a ‘currency demand paradox’ of banknotes in circulation, even as digital payments are on the rise, driven by cautious households.

According to the Reserve Bank of India, households hold more high-value currencies even as they replace lower-value currency with digital transactions. “While UPI-led retail digital payments grew at a compound annual growth rate (CAGR) of 50% and 27% in terms of volume and value, respectively (during 2016-17 to 2021-22), the currency-in-circulation – GDP ratio too Rose and reached 14.4% in 2020- 21,” RBI said in its annual report.

According to the Reserve Bank of India, households hold more high-value currencies even as they replace lower-value currency with digital transactions. “While UPI-led retail digital payments grew at a compound annual growth rate (CAGR) of 50% and 27% in terms of volume and value, respectively (during 2016-17 to 2021-22), the currency-in-circulation – GDP ratio too Rose and reached 14.4% in 2020- 21,” RBI said in its annual report.

RBI said the demand was mainly for precautionary purpose and the recent data shows that there has been a shift in the pandemic induced precautionary demand for cash. Currency in circulation has increased in single digits year-on-year for 86 weeks since August 2021 (excluding April 2022).

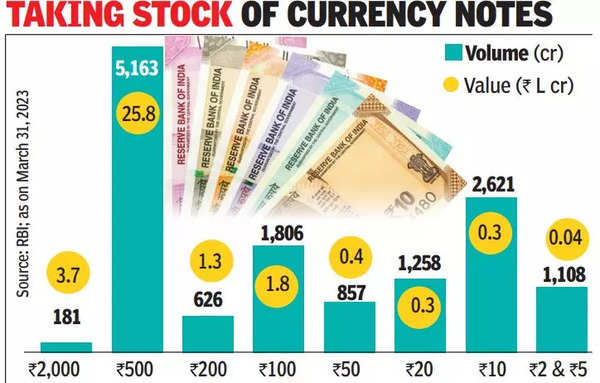

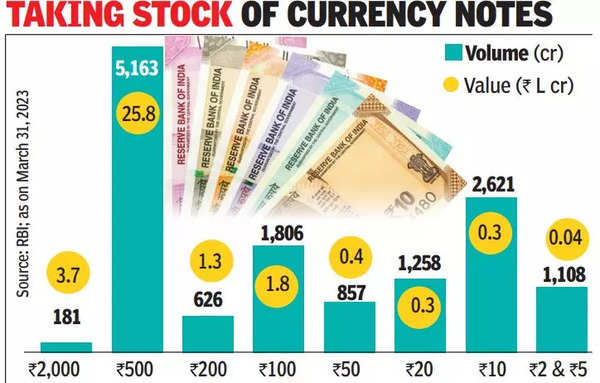

The value and quantity of banknotes in circulation increased by 7.8% and 4.4%, respectively, during 2022-23 as compared to 9.9% and 5%, respectively, during 2021-22. In terms of value, the share of Rs 500 and Rs 2,000 banknotes as on March 31, 2023 was 87.9% of the total value of banknotes in circulation as on March 31, 2023 as against 87.1% as on March 31, 2023.