The top 1% of individual taxpayers experienced a 42% increase in average gross total income, while the bottom 25% saw a 58% increase.The proportionate contribution of the top 1% to the overall gross total income declined from 15.9% in assessment year 2013-14 to 14.6% in assessment year 2021-22.

Income taxpayers on the rise

The CBDT considers this data as evidence of robust growth in the gross total income of individuals in various income brackets since assessment year 2013-14. This growth has had a positive impact on net direct tax collections, which have risen from Rs 6.38 lakh crore in fiscal year 2013-14 to Rs 16.61 lakh crore in fiscal year 2022-23.

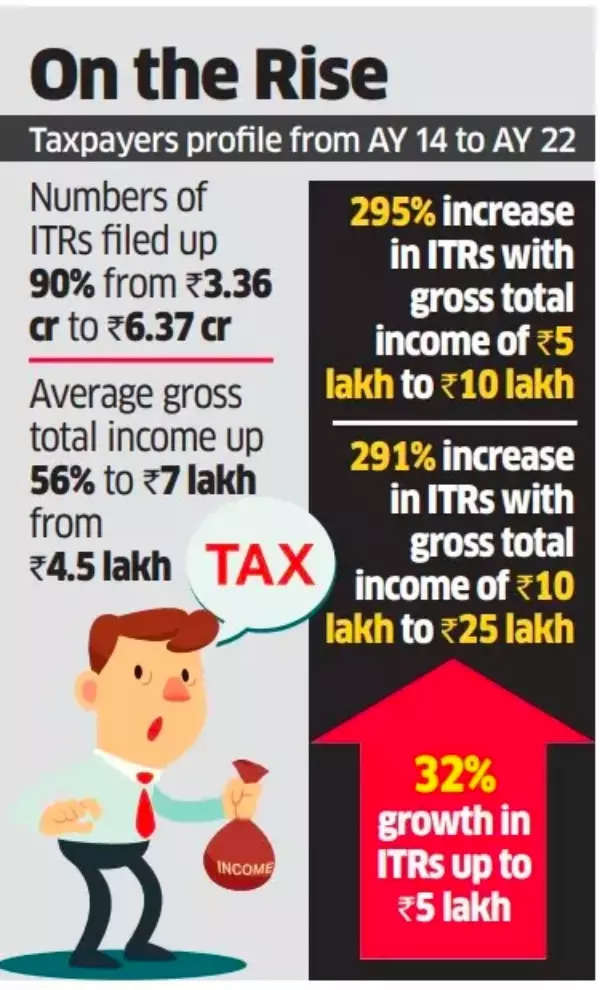

In addition to the increase in income, tax compliance has also improved during this period. Individual taxpayers have shown a positive trend of shifting to higher ranges of gross total income, CBDT said. The number of income-tax returns filed by individuals in the Rs 5-10 lakh and Rs 10-25 lakh income brackets has witnessed a significant surge of 295% and 291% respectively. “This indicates that individual taxpayers are showing a positive trend of migration to a higher range of gross total income,” CBDT said.

Income Tax Return: Filing belated/late or revised ITR? Know penalty, interest payment, refund impact

The number of income-tax returns filed by individual taxpayers has increased by 90% over the past eight years, reaching 63.7 million in assessment year 2021-22. Moreover, during the current financial year, 74.1 million returns have already been filed for assessment year 2023-24, including 5.3 million first-time filers.

The CBDT attributes this expansion of the taxpayer base to various reform measures implemented by the department.