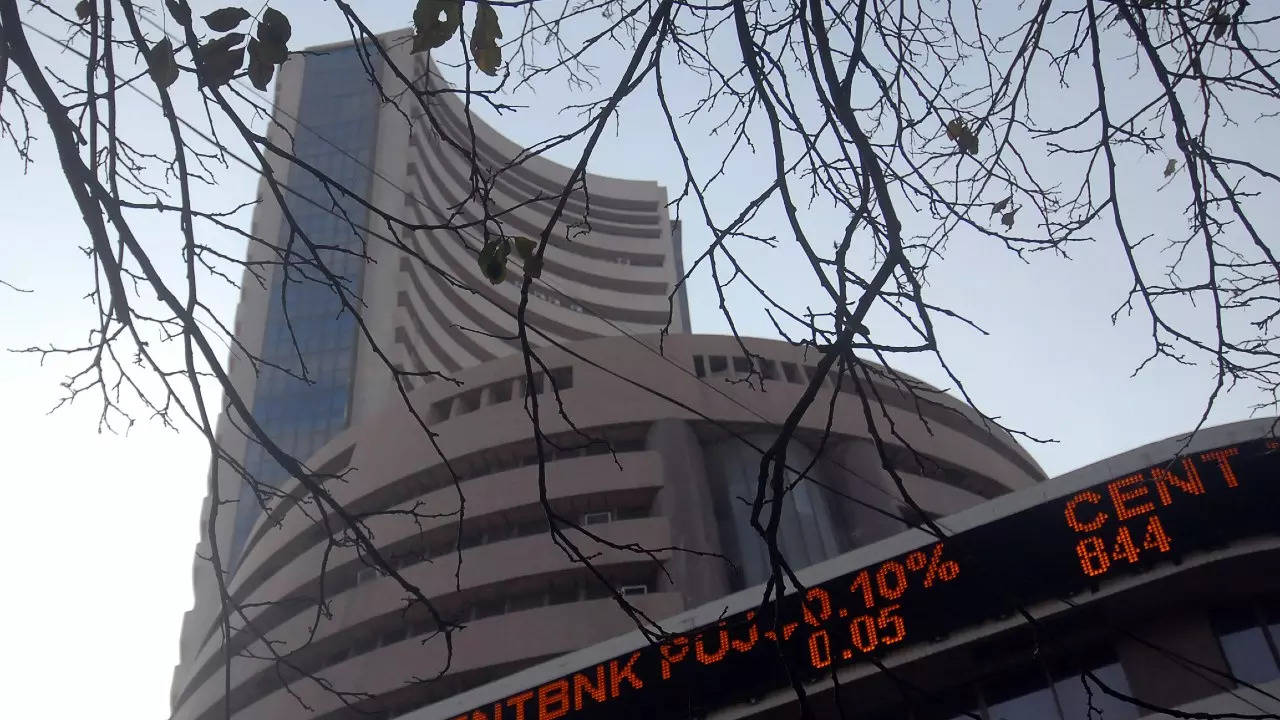

Mumbai: Benchmark indices climbed in early trade on Wednesday BSE Sensex The major index reached its all-time high of 63,588.31 amid buying HDFC Twins and Reliance Industries.

BSE with 30 shares Sensex In early trade, it climbed 146 points to close at 63,473.70. nse nifty rose 37 points to 18,853.70.

Later, the BSE benchmark jumped 260.61 points to its all-time high of 63,588.31. The benchmark has reached this milestone after a gap of about seven months.

Last year on December 1, Sensex touched its intra-day record peak of 63,583.07.

From the Sensex pack, Power Grid, UltraTech Cement, HDFC Bank, wiproHDFC, Hindustan Unilever, Larsen & Toubro, Tech Mahindra, Bajaj Finserv, Titan, Tata Consultancy Services and Reliance Industries were the major gainers.

Tata Steel, NTPC, Tata Motors, ICICI BankAnd Asian Paints was among the laggards.

In Asian bourses, Tokyo quoted in the green, while Seoul, Shanghai and Hong Kong were trading lower.

US markets closed down on Tuesday.

Global oil benchmark Brent crude climbed 0.26 per cent to $76.09 a barrel.

Foreign institutional investors (FIIs) sold shares worth Rs 1,942.62 crore on Tuesday, according to exchange data.

“It is important to understand that this is a global rally with most markets – the US, the euro zone, Japan, South Korea and Taiwan – hovering near 52-week highs … Global markets are rallying even as global growth is sluggish I have speed.

“The reason for this bullish trend is that the US recession, which the markets discounted last year, has not happened and there are signs that the US may avoid recession. Therefore, the markets are correcting the wrong discounting of last year, said Vijayakumar, chief investment strategist at VK Geojit Financial Services.

The 30-share BSE benchmark closed 159.40 points, or 0.25 per cent, higher at 63,327.70 on Tuesday. The Nifty closed at 18,816.70, up 61.25 points or 0.33 per cent.

“All eyes will be on the US Federal Reserve Chairman’s testimony before the US Congress later today,” said Prashant Tapase, Senior VP (Research), Mehta Equities Ltd.

BSE with 30 shares Sensex In early trade, it climbed 146 points to close at 63,473.70. nse nifty rose 37 points to 18,853.70.

Later, the BSE benchmark jumped 260.61 points to its all-time high of 63,588.31. The benchmark has reached this milestone after a gap of about seven months.

Last year on December 1, Sensex touched its intra-day record peak of 63,583.07.

From the Sensex pack, Power Grid, UltraTech Cement, HDFC Bank, wiproHDFC, Hindustan Unilever, Larsen & Toubro, Tech Mahindra, Bajaj Finserv, Titan, Tata Consultancy Services and Reliance Industries were the major gainers.

Tata Steel, NTPC, Tata Motors, ICICI BankAnd Asian Paints was among the laggards.

In Asian bourses, Tokyo quoted in the green, while Seoul, Shanghai and Hong Kong were trading lower.

US markets closed down on Tuesday.

Global oil benchmark Brent crude climbed 0.26 per cent to $76.09 a barrel.

Foreign institutional investors (FIIs) sold shares worth Rs 1,942.62 crore on Tuesday, according to exchange data.

“It is important to understand that this is a global rally with most markets – the US, the euro zone, Japan, South Korea and Taiwan – hovering near 52-week highs … Global markets are rallying even as global growth is sluggish I have speed.

“The reason for this bullish trend is that the US recession, which the markets discounted last year, has not happened and there are signs that the US may avoid recession. Therefore, the markets are correcting the wrong discounting of last year, said Vijayakumar, chief investment strategist at VK Geojit Financial Services.

The 30-share BSE benchmark closed 159.40 points, or 0.25 per cent, higher at 63,327.70 on Tuesday. The Nifty closed at 18,816.70, up 61.25 points or 0.33 per cent.

“All eyes will be on the US Federal Reserve Chairman’s testimony before the US Congress later today,” said Prashant Tapase, Senior VP (Research), Mehta Equities Ltd.