Borrowers of small-ticket personal loans are more likely to default – many of them are saddled with multiple loans with overdue payments, a study by credit information company TransUnion Cibil showed.

According to the study, since January 2022, small-ticket personal loans have accounted for approximately 25% of total new loans in volume. The share of credit-active individuals availing a small-ticket loan has increased to 8% in June 2023 from 3% in June 2019.

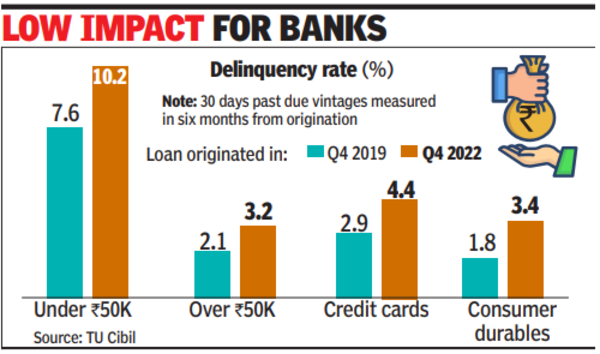

For consumers with at least one small-ticket loan, the delinquency rate was 5.4%, compared to 4.2% in Q2 2022. Despite this increase, delinquencies in this portfolio have had only a marginal impact on the overall retail loan book of lenders. In terms of value, these loans represent only 0.3% of retail credit. This is because most bank lending to individuals is through home loans, auto loans, credit cards, and personal loans of over Rs 50,000.

“Even though delinquencies on small-ticket loans have a marginal impact on the personal loan portfolio, they need to be closely monitored, especially because consumers may prioritise other payment obligations ahead of personal loan payments, which may be a broader indicator of financial stress,” TU Cibil said in its report.

There are also signs of over-leverage among borrowers in this segment. In Q2 2023, approximately half (51%) of consumers who availed small-ticket loans had more than four credit products at the time of availing another new loan, compared to just 17% in that category in Q2 2019.

According to the data, delinquencies in all individual loan segments have improved except for personal loans and credit cards, where they have worsened. In personal loans, accounts with overdue payments of more than 90 days have increased to 0.84% from 0.44% last year. In credit cards, delinquencies have increased to 1.63% from 1.46%. The most significant improvement has been in loans against property, where delinquencies have dropped to 2.18% from 3.19%.

There has been a major decrease in the approval rate across all retail loan segments in the second quarter of FY23 compared to the year-ago period, indicating that either lenders have become more selective or loan applicants are less creditworthy.

The biggest decrease is in personal loans, where the approval rate has fallen from 25% in Q2FY22 to 18% in Q2FY23. In auto loans, only 36% of inquiries lead to sanctions, compared to 43% a year ago. In the case of home loans, which are secured debts, only 35% of credit seekers qualify, as opposed to 40% earlier. The only segment that has shown improvement is consumer durable loans, where the approval rate has risen to 33% from 30% last year.

In terms of outstanding loans, the most significant increase in portfolio balances has been in two-wheeler loans and credit cards.