The government has formed a committee led by finance secretary TV Somanathan to standardise and ensure interoperable KYC norms across the financial sector.

We are considering using multi-level secondary identifiers such as PAN, Aadhaar, and unique mobile number (UMN) for joint accounts, a senior bank executive was quoted as saying by ET.

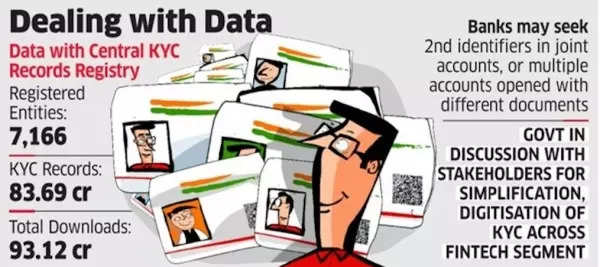

Banks dealing with Data

These secondary identifiers will help trace multiple accounts of an individual if they are not linked and have been opened using different KYC documents. Furthermore, this will facilitate the extension of the account aggregator (AA) network to joint accounts.

Currently, the AA framework only includes single-operated individual accounts for sharing financial information. An account aggregator retrieves or collects information about a customer’s financial assets from the holders of such information and presents it to specified users.

Presently, a passport, Aadhaar, voter card, NREGA card, PAN card, or driving licence can be used to open a bank account.

Last month, the Finance Stability and Development Council (FSDC) discussed uniform KYC norms, inter-usability of KYC records, and simplification and digitalisation of the KYC process.

“In the last year, we, through the Indian Banks’ Association, or IBA, shared our concern with the RBI on slackened KYC norms by fintech companies,” said another banker. They also highlighted that some of these firms do not report to credit bureaus, which increases the risk for other lenders relying on credit bureau data.