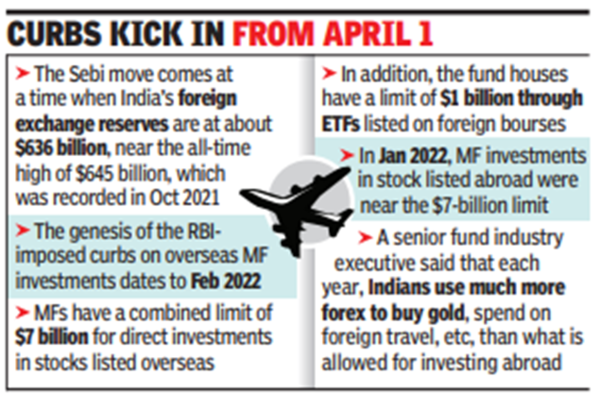

Despite several representations to RBI over the years, the central bank is yet to increase this investment limit.Recently when the RBI governor was asked about a possible enhancement of the limit, he said that “when the rupee shows stability, the central bank will look into this issue”. The Sebi move comes at a time when India’s foreign exchange reserves are at about $636 billion, nearing the all-time high of $645 billion, which was recorded in Oct 2021. The genesis of the RBI-imposed restriction on overseas investments by MFs dates to Feb 2022. At the time, the combined MFs had a limit of $7 billion for direct investments in stocks listed overseas. In addition, the fund houses had a limit of $1 billion through ETFs listed on foreign bourses.

In Jan 2022, MFs’ aggregate investments in stock listed abroad were near the $7-billion limit. Sebi asked fund houses to not invest any more in those stocks. However, Sebi said that in case fund houses saw some redemptions from their portfolios that reduced their overseas exposure through investments in stocks, they could re-invest to fill that gap but should never exhaust the RBI-imposed limit.

An email from MF body Amfi to fund houses said: “The investment in overseas securities (in other overseas scheme – other than overseas ETFs) may continue till further communication from Sebi.” Currently, MFs are at 84% of the $7-billion limit and at 95% of the $1-billion cab, a top executive at a fund house said.

While RBI has an annual limit of $250,000 per person limit for Indian individuals to spend foreign exchange through its liberalised remittance scheme, the limit for investing through domestic MFs is cumulative in nature. “At a time when we are talking about promoting India at the global stage, if we consider the total overseas investment limit for MFs, for 1.4 billion people, it’s just $5.7-per-Indian citizen,” said a top fund industry executive. “Each year, Indians spend much more foreign exchange to buy gold, on foreign travel, etc, than what’s allowed for investing abroad.”