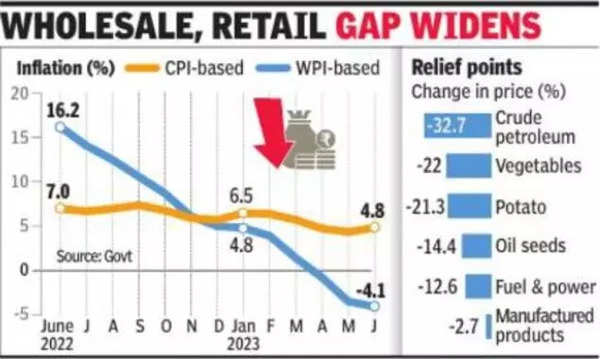

Data released by the Ministry of Commerce and Industry on Friday showed that inflation based on the Wholesale Price Index (WPI) fell to 4.1% in June from 3.5% in May. According to the government statement, the contraction in the rate of inflation in June, 2023 is mainly due to decline in prices of mineral oils, food products, basic metals, crude petroleum and natural gas and textiles.

Earlier this week, data was released National Statistics Office (NSO) showed retail inflation Rose At a three-month high of 4.8% in June, up from 4.3% in May. The food index rose to 4.5% during the month from about 3% in May. Vegetable prices declined by 22% and manufactured product prices by 2.7% in June. The prices of cereals and pulses remained firm, reflecting the doggedness in the retail inflation data. experts said reserve Bank of India (RBI) may increase its moratorium on interest rates and keep an eye on the situation. The easing of inflationary pressures prompted the central bank to pause its interest rate-raising cycle.

“WPI deflation declined further in June, and with CPI inflation rising faster than expected, the gap between wholesale and retail inflation continues to widen. We expect retail inflation to pick up this quarter on the back of food prices. The higher-than-expected June CPI print and likely higher trajectory for July have prompted us to raise our average CPI inflation forecast for FY2013-24 to 5% from 4.7%, Barclays said in a note.

“Thus, the deceleration in core CPI inflation is likely to be gradual. Accordingly, we are seeing a widening of the gap between CPI and WPI inflation. We feel that the recent rise in food prices may make the RBI cautious, but we still expect it to remain contained for an extended period, without giving up its grip on inflation.