He termed the report by American shortsellers a “deliberate and malicious effort aimed at damaging our reputation and profiting through short-term drive-downs in our stock prices.”

The business tycoon once again invoked the nationalist spirit in his fight against Hindenburg, who “launched the report on the eve of our Republic Day this year, when we plan to launch the biggest follow-on public offering in India’s history”. were staying”. He said that the Adani Group is defined by flexibility. “Resilience is what allows us to come back stronger each time we get hurt. The resilience that inspires our faith in the nation we call our motherland. ,

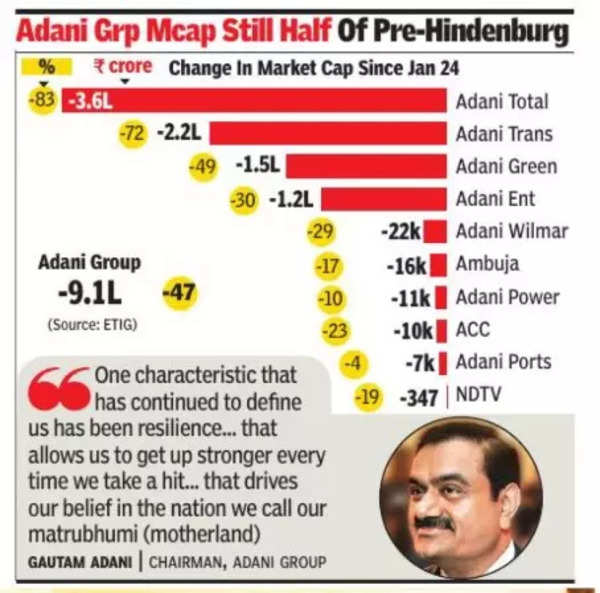

Following the report, the group has lost billions of dollars in market capitalization and has struggled to repair the damage caused by the 106-page document. “While we immediately issued a comprehensive rebuttal, various vested interests tried to take advantage of the claims made by the short-seller. These entities encouraged and promoted false stories on various news and social media platforms,” Adani said.

Since then, the group has prioritized financial health over the aggressive debt-fuelled expansion of recent years. It pared debt, scaled back capital expenditure plans and canceled M&A deals. Adani also raised over $2 billion from Australia-listed asset manager GQG Partners to raise finance. “Our track record speaks for itself, and I am grateful for the support our stakeholders showed us when we went through our challenges. It is worth noting that even during this crisis – not only did we raise several billion dollars from international investors – but also that none of the credit agencies in India or abroad downgraded our ratings.

Adani, who founded the group three decades ago, said, “I never imagined that Adani Group would become one of the largest conglomerates in the country.” In FY23, the group posted a profit of Rs 23,509 crore on an income of Rs 2.6 lakh crore. Adani said, “We could choose to settle with mediocre growth numbers, or we could wake up each day believing that we are on the verge of being one of the most influential conglomerates our country has ever created.”