According to financial advisors, better return on investment, salary hike offered by companies and strong corporate earnings drove the increase in AUM in the state.

“Gujarat is a retail and corporate-dominated market for mutual fund investments. With the start of the new financial year, better salary hikes by companies put extra cash in the hands of people. It has been diverted towards investing in mutual funds and other asset classes. Preliminary estimates suggest earnings per share (EPS) on the Nifty 50 is up 19%, indicating good income from dividends for retail investors as well,” said an Ahmedabad-based financial advisor.

Indian equity markets have also performed well in May due to which the net asset value of existing investments has gone up. Industry players say strong corporate earnings as well as maturing bonds and deposits have also led to an increase in investment.

“The decision of the Reserve Bank of India (RBI) as well as the US Federal Reserve to halt interest rate hikes was seen as a sign of inflation coming under control. Such optimism fueled the rally of equity market indices, leading to a rise in AUM,” said a city-based financial advisor.

‘Fresh inflows driven by equity-linked MFs’

Corporate earnings were good at the end of the financial year. With the geopolitically uncertain situation and volatile demand trends, capital expenditure plans are currently on hold. As a result, the surplus cash earnings of the corporations have been re-invested after the financial year ends,” said the financial advisor.

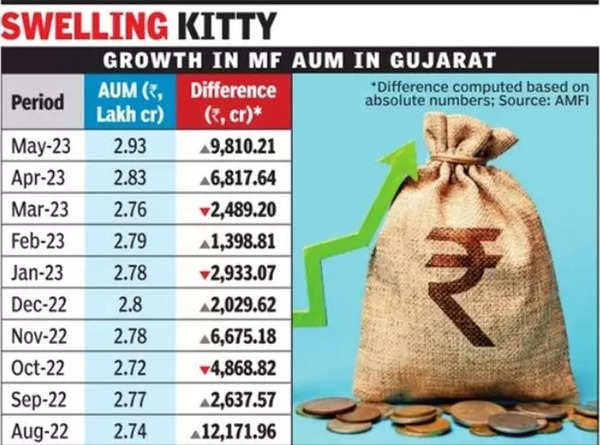

The majority of fresh inflows were driven by equity-linked MFs, where AUM increased by Rs 7,481 crore to stand at Rs 1.64 lakh crore in May. “Taking cues from retail and corporate earnings, several asset management companies have come out with new fund offers.

“It has also increased the interest of young investors to invest in MFs. Overall, inflows through systematic investment plans (SIPs) are also on the rise, keeping AUM buoyant,” said Kartik Patel, city-based mutual fund advisor.