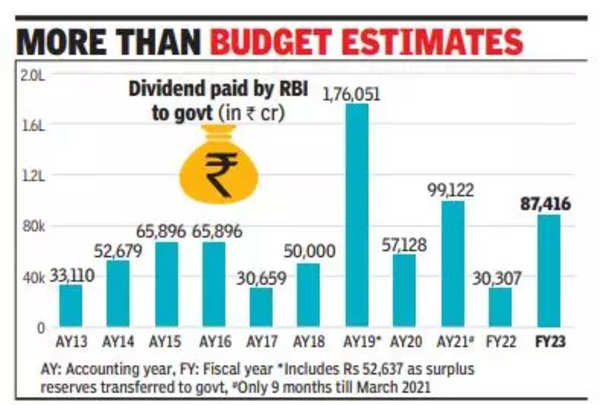

At Rs 87,416 cr, RBI’s dividend to government nearly 3 times last year’s

The Reserve Bank of India (RBI) has declared a dividend of Rs 87,416 crore to the government. This is almost three times the Rs 30,307 crore dividend paid by the central bank in the last financial year. This is also much higher than the estimated Rs 48,000 crore dividend for banks in the budget.

Economists said the higher dividend was a result of volatility in the forex market, which enabled the RBI to book huge profits through dollar selling. Dollar selling has a twin effect on the dividend paying capacity of the RBI. While selling dollars at higher exchange rates than the purchase price generates profit, the decline in balance sheet size reduces the need for provisions.

In view of this, the total dividend income of the government will be even higher. State Bank Of India Dividend payout has been increased to Rs 11.3 per share as against Rs 7.1 last year. A higher dividend income would enable the government to meet its fiscal deficit target of 5.9% of GDP. This will reduce the pressure to increase market borrowings.

“Since PSBs (public sector banks) have also posted very good profits and declared dividends, more will flow from this source as well. Add to this possibly higher dividend payouts by oil marketing companies and the situation looks quite comfortable , because it won’t.” leads to higher market borrowings,” said Mrs. SabnavisChief Economist at Bank of Baroda.

The 602nd meeting of the Central Board of RBI was held on Friday under the chairmanship of the Governor. Shaktikanta Das, The meeting focused on an assessment of the global and domestic economic scenario, taking into account the respective challenges and the likely impact of current geopolitical developments.

During the session, the Board decided to retain the Contingency Risk Buffer at 6%. It is a reserve fund to absorb any unforeseen losses or shocks that may arise in the future.