Mumbai: Benchmark Index Sensex And smelly Larsen & Toubro on Thursday pared early gains to close marginally lower in highly volatile trade dragged by heavy losses and cautious trade ahead of the release. domestic inflation data,

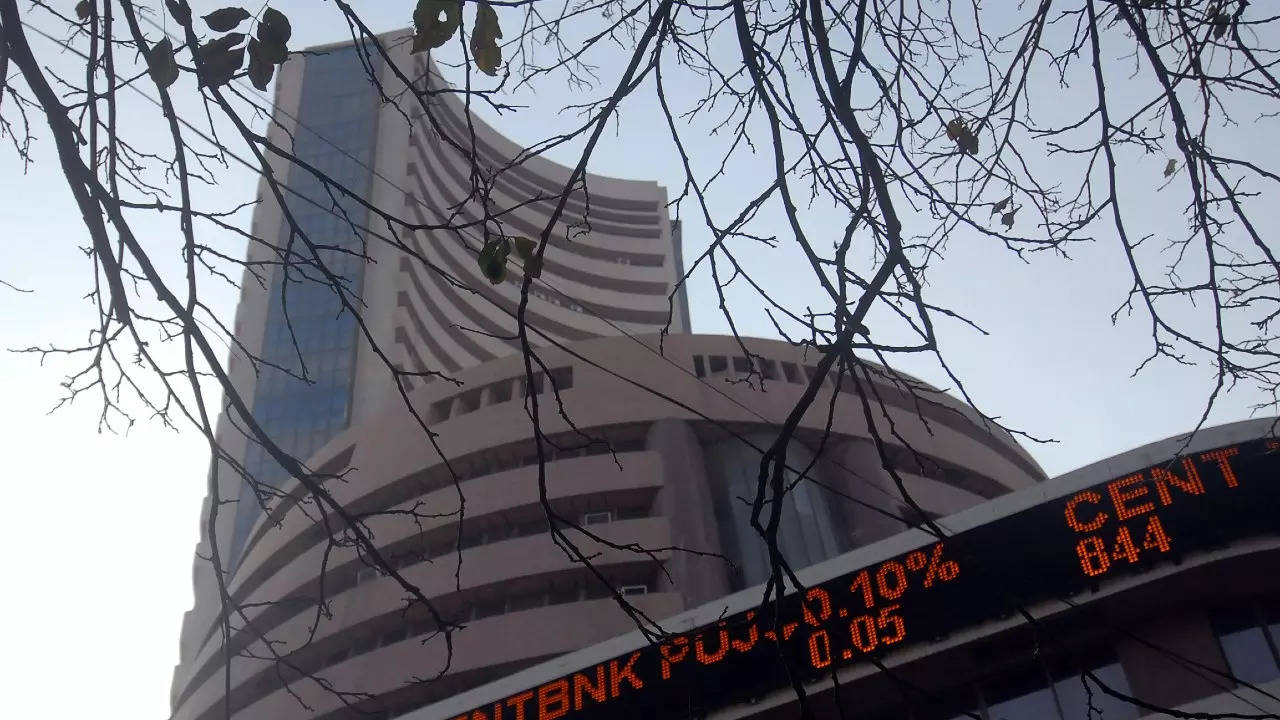

30-share BSE Sensex It closed at 61,904.52, down 35.68 points, or 0.06 per cent, after hitting the crucial 62,000 mark in early deals. It touched a low of 61,823.07 and a high of 62,168.22 in the day’s trade.

The NSE Nifty ended 18.10 points, or 0.10 per cent, lower at 18,297, with 21 of its constituents ending in the red while 29 in the green.

Among Sensex firms, Larsen & Toubro declined over 5 per cent after the firm said its non-executive chairman AM Naik has decided to step down.

ITCBharti Airtel, Reliance Industries, InfosysTata Steel, Tech Mahindra and Tata Consultancy Services were the other laggards.

Asian Paints, however, posted a 43.97 per cent rise in consolidated net profit for the fourth quarter, up 3.22 per cent to Rs 1,258.41 crore.

Hindustan UnileverNTPC, IndusInd Bank, UltraTech Cement and Maruti gained.

“Weak earnings reported by some heavyweights capped gains in the domestic market,” said Vinod Nair, Head of Research, Geojit Financial Services.

“Weak Asian cues dampened sentiment as local markets remained weak throughout the trading session before finally ending marginally lower amid sell-off in metal and capital goods stocks. After a sharp rally in recent sessions, investors may take a wet- In end-watch mode.” said Shrikant Chauhan, head of equity research (retail), Kotak Securities Ltd.

In the broader market, the BSE Smallcap gauge climbed 0.68 per cent and the Midcap index rose 0.36 per cent.

Indices capital goods fell 1.94 per cent and metals 1.25 per cent while industrials (0.92 per cent) and tech (0.19 per cent) also closed with losses.

Electricity grew by 1.34 percent, utilities by 1.02 percent, consumer discretionary (0.73 percent), consumer durables (0.72 percent) and financial services (0.36 percent).

On the global front, the U.S. inflation Nair said that fell below 5 per cent, giving investors assurance that the Fed’s rate hike measures have been effective in managing inflation levels.

Investors are also waiting for the domestic inflation rate to be released on Friday.

In Asia, bourses in Seoul, Shanghai and Hong Kong ended with losses while Tokyo ended in the green.

Europe’s markets were trading in the green mark. On Wednesday, the US market closed mostly in the negative range.

Foreign institutional investors (FIIs) were net buyers on Wednesday, buying shares worth Rs 1,833.13 crore, according to exchange data.

Meanwhile, global oil benchmark Brent crude jumped 0.93 per cent to $77.12 per barrel.

30-share BSE Sensex It closed at 61,904.52, down 35.68 points, or 0.06 per cent, after hitting the crucial 62,000 mark in early deals. It touched a low of 61,823.07 and a high of 62,168.22 in the day’s trade.

The NSE Nifty ended 18.10 points, or 0.10 per cent, lower at 18,297, with 21 of its constituents ending in the red while 29 in the green.

Among Sensex firms, Larsen & Toubro declined over 5 per cent after the firm said its non-executive chairman AM Naik has decided to step down.

ITCBharti Airtel, Reliance Industries, InfosysTata Steel, Tech Mahindra and Tata Consultancy Services were the other laggards.

Asian Paints, however, posted a 43.97 per cent rise in consolidated net profit for the fourth quarter, up 3.22 per cent to Rs 1,258.41 crore.

Hindustan UnileverNTPC, IndusInd Bank, UltraTech Cement and Maruti gained.

“Weak earnings reported by some heavyweights capped gains in the domestic market,” said Vinod Nair, Head of Research, Geojit Financial Services.

“Weak Asian cues dampened sentiment as local markets remained weak throughout the trading session before finally ending marginally lower amid sell-off in metal and capital goods stocks. After a sharp rally in recent sessions, investors may take a wet- In end-watch mode.” said Shrikant Chauhan, head of equity research (retail), Kotak Securities Ltd.

In the broader market, the BSE Smallcap gauge climbed 0.68 per cent and the Midcap index rose 0.36 per cent.

Indices capital goods fell 1.94 per cent and metals 1.25 per cent while industrials (0.92 per cent) and tech (0.19 per cent) also closed with losses.

Electricity grew by 1.34 percent, utilities by 1.02 percent, consumer discretionary (0.73 percent), consumer durables (0.72 percent) and financial services (0.36 percent).

On the global front, the U.S. inflation Nair said that fell below 5 per cent, giving investors assurance that the Fed’s rate hike measures have been effective in managing inflation levels.

Investors are also waiting for the domestic inflation rate to be released on Friday.

In Asia, bourses in Seoul, Shanghai and Hong Kong ended with losses while Tokyo ended in the green.

Europe’s markets were trading in the green mark. On Wednesday, the US market closed mostly in the negative range.

Foreign institutional investors (FIIs) were net buyers on Wednesday, buying shares worth Rs 1,833.13 crore, according to exchange data.

Meanwhile, global oil benchmark Brent crude jumped 0.93 per cent to $77.12 per barrel.